Financial Planning

42 articles in this category

A Comprehensive Guide to Tax Benefits and Financial Growth Investing in mutual funds in a kid’s name is not only a strategic financial decision but also offers significant tax advantages, especially in India. This article delves into the numerous merits of such investments, particularly from a tax perspective, and provides insights on how to maximize … The Merits of Investing in Mutual Funds in your Kid’s Name in India Read More »

7 December 2019

Retirement planning – How much is enough?

“You can be young without money, but you can’t be old without it.” – Tennessee Williams. Key takeaways: Retirement shouldn’t mean an inactive life. It should also not mean no income at all. Ideally, it should lead to you doing something more meaningful that inspires you. Prior to retirement, it is essential to be debt … Retirement planning – How much is enough? Read More »

5 December 2019

What is the best tax saving option?

“In this world, nothing can be said to be certain except death and taxes” – Benjamin Franklin While taxes are certain, there are legitimate ways to reduce taxes. I firmly believe that as responsible citizen, I must pay a fair share of taxes. However, I also believe that we owe it to our family that … What is the best tax saving option? Read More »

28 November 2019

What to do when banks are cutting FD rates?

“If you never try, you will never know.” – Unknown Key takeaways: With falling fixed deposit interest rate, it is time to look at other options that can deliver better post-tax return. Debt mutual funds can be a good alternative to fixed deposit. It is more tax efficient and offers a lot of flexibility. … What to do when banks are cutting FD rates? Read More »

7 July 2019

Mutual fund investments for your child

“Failing to plan is planning to fail.” – Benjamin Franklin Summary: Rising cost of education means we must plan to meet the expenses for our child’s education. The first step is to fix the financial goal. We must ascertain how much money we will need and when will we need it. We can then calculate … Mutual fund investments for your child Read More »

18 August 2018

Don’t delay, start investing today!

It’s a job that’s never started that takes the longest to finish.” – J. R. R. Tolkien Summary: Beware of the changes taking place. High life expectancy, higher job uncertainty and absence of guaranteed inflation-linked pension puts the onus of secure financial future on you. Your actions today can be the difference between a comfortable financial life … Don’t delay, start investing today! Read More »

14 August 2018

How to become financially free?

“Financial freedom is freedom from fear.” – Robert Kiyosaki Path to financial freedom: Financial freedom should be the ultimate aim of our life as it gives the freedom to choose what to do, when to do and how to do. Financial freedom requires careful planning, unflinching discipline to stick to the plan and enormous patience … How to become financially free? Read More »

3 April 2018

Bursting some myths about LTCG tax – Part 1

“There is nothing more deceptive than an obvious fact.” ―Arthur Conan Doyle In the latest budget, Finance Minister Arun Jaitley, reintroduced Long-term capital gain tax for equity investments starting 1st April 2018. After the imposition of LTCG tax, there was lot of confusion and discussion. I tried to introduce the concept of LTCG tax on equities … Bursting some myths about LTCG tax – Part 1 Read More »

31 March 2018

All you wanted to know about LTCG taxes on equities!

“In this world, nothing can be said to be certain, except death and taxes.” – Benjamin Franklin In the latest budget, Finance Minister Arun Jaitley, reintroduced Long-term capital gain tax for equity investments starting 1st April 2018. For some time now, It was widely rumoured that such a tax will come into effect. So, when … All you wanted to know about LTCG taxes on equities! Read More »

4 December 2017

Buy or rent a flat- What makes financial sense?

Buying a home is often an emotional decision. Who can argue with a desire to have a roof over your head without having to think about paying the rent every month? However, paying EMI is equally big headache. Especially in current environment where job security is a thing of past. If one is a buying … Buy or rent a flat- What makes financial sense? Read More »

28 November 2017

How much to invest to create 1 crore corpus?

“Spend less than you make; always be saving something. Put it into a tax-deferred account. Over time, it will begin to amount to something. This is such a no-brainer.” — Charlie Munger Having 1 crore rupee (10 million for those outside India) is a nice sum of money. It embeds a sense of security in our … How much to invest to create 1 crore corpus? Read More »

4 November 2017

Balanced fund or equity fund – Case study

The devil is in the detail. Recently, we wrote about how balanced funds are a good option for steady returns. Indeed, balanced fund with in-built asset allocation tend to navigate the volatile market well. But the proof of pudding is in eating. Hence, we try to look at risk and return characteristics of decent balanced … Balanced fund or equity fund – Case study Read More »

21 October 2017

Balance fund – solid option for steady returns

“Rule No.1: Never lose money. Rule No.2: Never forget rule No.1.” – Warren Buffett In investing it is important not to lose money. We can avoid losing money in market by completely remaining out of the market. But if that were the intention, you wouldn’t have been reading it. You have to be “in it” to “win … Balance fund – solid option for steady returns Read More »

16 October 2017

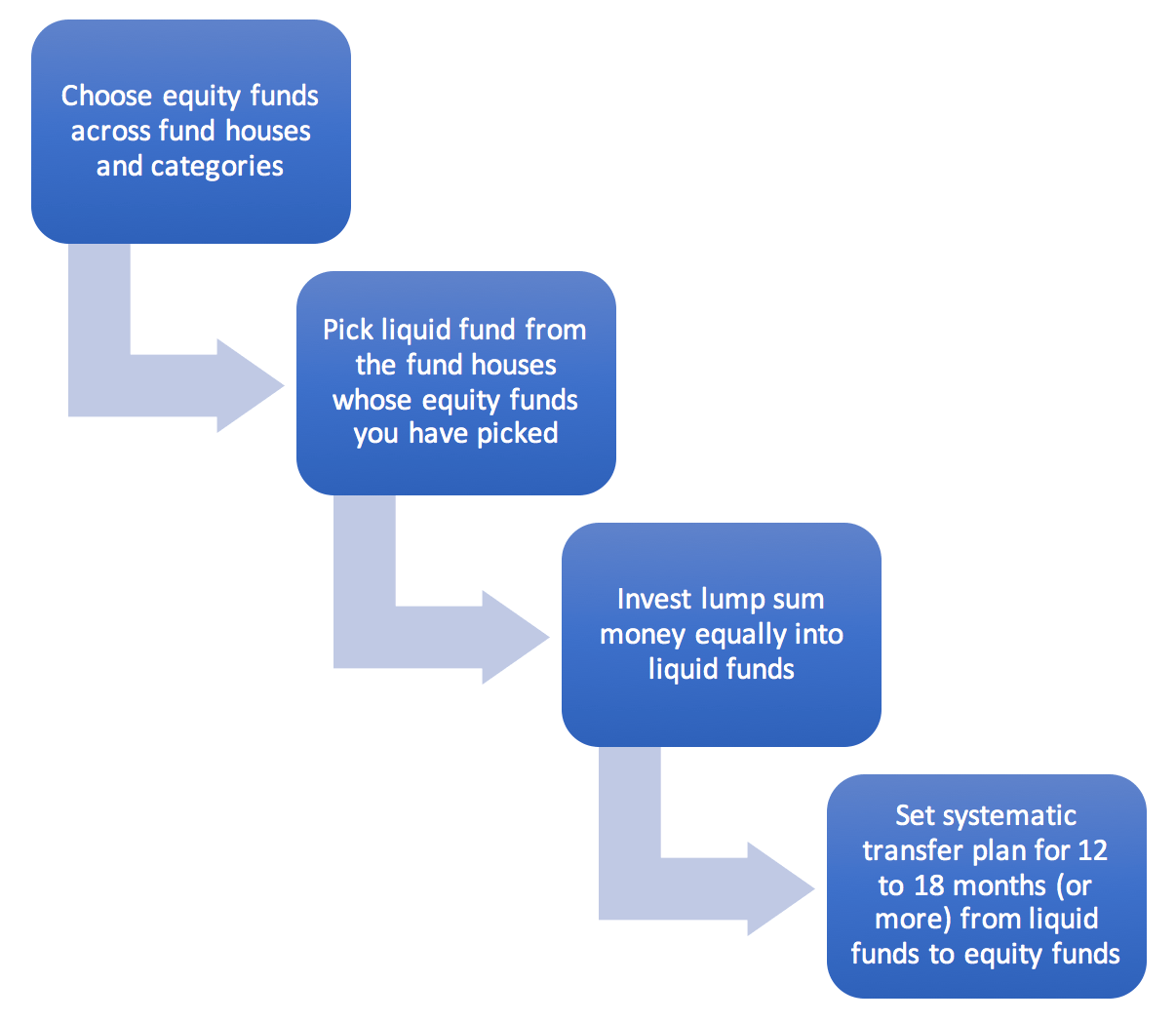

How to invest lump sum amount into equity mutual funds?

Many times people ask me that their LIC policy matured and they have some money to invest. Salaried people get annual bonus which could be a large amount (if you are lucky:)). They ask what’s the best way to invest lump sum amount. Below, I am going to explain how this should be done to … How to invest lump sum amount into equity mutual funds? Read More »

7 October 2017

How expensive is the Indian equity market?

“Only liars manage always to be out of the market during bad times and in during good times.” -Burton Malkiel This simply means that timing the market is almost impossible to do on consistent basis. So, here we are not talking about timing the market but on asset allocation. Any one who was panicking last … How expensive is the Indian equity market? Read More »

4 October 2017

Mutual fund investment strategy for kid’s education

A goal without a plan is just a wish – Antoine de Saint – Exupery This is the third and final part of our series on how to fund kid’s education. In our first article, we got an idea about the cost of higher education at different type of institute in India and abroad (Plan … Mutual fund investment strategy for kid’s education Read More »

30 September 2017

INFLATION – Ignore at your own peril!

Inflation is when you pay fifteen dollars for a ten-dollar haircut that you used to get for five dollars – Sam Ewing The seeds of second world war were sown during the hyper-inflationary period in Germany (after the first world war). Inflation is indeed a big tax on savers. Well, in my family, I was … INFLATION – Ignore at your own peril! Read More »

29 September 2017

Do’s and don’ts of mutual fund investing

Mutual funds are great way to create wealth. However, there is a big difference in what return mutual funds generate and what return investors get. This is an attempt to bridge the gap between mutual fund returns and your return by avoiding some common mistakes. Some mistakes commonly made are: Trying to time the market … Do’s and don’ts of mutual fund investing Read More »

24 September 2017

How NRIs can invest in Indian mutual funds?

In our earlier video (Why NRIs should invest in India) , we discussed why India remains a compelling investment destination for non-resident Indians. Based on our earlier video, we receive how NRIs can invest in India. We believe the best way to invest in India is through mutual funds. Refer to the NRI section of … How NRIs can invest in Indian mutual funds? Read More »

24 September 2017

Planning for kid’s education- go mutual fund way!

The roots of education are bitter but the fruit is sweet – Aristotle The biggest satisfaction for parents is to see their kid’s well educated and well settled. That’s mission accomplished and a big relief for parents in their retirement years. Many times I meet parents of successful people and I feel a sense of … Planning for kid’s education- go mutual fund way! Read More »

21 September 2017

Plan for kid’s education- How much will it cost?

An investment in knowledge pays the best interest – Benjamin Franklin I studied in a government school where semi-annual fee was 57 rupees. Later on, I qualified to study at one of the IITs, considered the best engineering college in India. During those days (around 20 years ago) the total fee for the 4 year … Plan for kid’s education- How much will it cost? Read More »

20 September 2017

Don’t forget to appoint a nominee

I know of a case where a person who was a diligent investor died and his family was totally in the dark about his investments. It was harried few months for the worried family to find all info on his investments. He not only made a mistake in keeping all his investments to himself but … Don’t forget to appoint a nominee Read More »

3 September 2017

Four key elements of effective investing

Most of the time people looking to invest get bogged down with what return should be expected. Instead of looking at the big picture, we waste time about timing the market (elusive dream of buying at the market bottom and selling at the peak) and high growth. The equation of effective investing is quite simple, … Four key elements of effective investing Read More »

28 August 2017

What return to expect from equities?

Most of the time when people look to invest in equity mutual funds, they ask what return should they expect. Unlike other popular investment options like PPF, fixed deposits etc, where investor has good idea about what return to expect, there is no guarantee for a particular level of return from equities. Lot of people … What return to expect from equities? Read More »

27 August 2017

Prepare for the financial challenges coming your way

Over the last 6 months, a few of my friends were laid off. They are in late 30s and early 40s. They are well educated and have worked at some of the best firms in the world. However, despite their best effort over the last 7-8 months, they have not been able to find suitable … Prepare for the financial challenges coming your way Read More »

Over the last few days, we saw many banks cutting rates on saving account balances. The interest on bank fixed deposits has also fallen. Interest income on bank fixed deposits is clubbed with your taxable income and is taxed at your marginal tax rate. Unlike bank FDs, debt mutual funds offer three key advantages: Easy … Bank cutting rates – Move your cash to debt mutual funds! Read More »

29 July 2017

NIFTY at 10000, so what?

There is a saying in Hindi: धीरे धीरे रे मना धीरे सब कुछ होय | माली सींचै सौ घड़ा ऋतू आये फल होय || This means that everything happens gradually and not before its time. A gardener waters the plants daily but the plants bear fruits only in the right season. In the last few … NIFTY at 10000, so what? Read More »

27 May 2017

five steps to declutter our financial life?

My father-in-law belongs to old school. He has retired recently and thought of organising his finances. During the course of this, he came across some fixed deposit receipts that he had started couple of decades ago. When he had started those deposits, he was told that they will be renewed automatically once they mature. To … five steps to declutter our financial life? Read More »

The hardest thing to understand in the world is income tax- Albert Einstein Recently, I met an old friend. He is very sceptical about mutual funds and considers them risky. When I talked about debt oriented mutual funds who don’t have the same risk profile as equity funds, he was not convinced. While he agreed … Fixed deposit Vs. debt mutual fund – What to pick? Read More »

15 April 2017

Systematic investment plans – How to make money?

Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections themselves- Peter Lynch During my initial days of investing, I felt that systematic investment plans are not very smart. However, over the years, I have realized that it is one of the most … Systematic investment plans – How to make money? Read More »

14 April 2017

Using valuation as a guide for asset allocation

I’ve never known anybody who can time the market. I’ve never known anybody who knows anybody who can consistently time the market- Burton Malkiel Aiming to time the market is futile.Purpose of this article is to focus more on asset allocation. We all know that right asset allocation is the main driver of portfolio returns. In … Using valuation as a guide for asset allocation Read More »

21 March 2017

Beauty of compounding and staying the course

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.” – Albert Einstein It is quite common to refer to the wonders of compounding However, this is often forgotten in financial planning. The pace of compounding is quite low in the beginning as … Beauty of compounding and staying the course Read More »

19 March 2017

How much it will cost to retire comfortably?

And in the end, it’s not the years in your life that count. It’s the life in your years. – Abraham Lincoln The world is becoming an increasingly old. Life expectancy has been increasing. As a result, many people find themselves not fully prepared for a long retired life. Preparation for retirement should ideally be … How much it will cost to retire comfortably? Read More »

27 February 2017

The case for long term debt mutual funds?

The article was first written in May 2015. Since then yield came down crashing and long-term gilt funds delivered great return. The yields have changed since then and there is upside risk and hence, one needs to prefer short term govt bond funds. I am reposting this, just to clarify few conceptual points that many … The case for long term debt mutual funds? Read More »

27 February 2017

Using valuation as a guide for investing

In my personal experience, a simple approach to investing works the best. The simple idea that works is to invest regularly at all times, invest more when valuation is attractive (NIFTY PE less than 18.6) and take some money of the table when valuation is expensive (NIFTY PE >22.1). The below points illustrate this: 1. … Using valuation as a guide for investing Read More »

“The investor’s chief problem—and even his worst enemy—is likely to be himself.” – Benjamin Graham Recently, I have been reading a book on behavioural investing by James Montier. The book gives a lot of insights into the behavioural mistakes that most investors make. It also argues that successful investing a a lot of about following … Cannot control the market, control yourself for investment success Read More »

27 February 2017

Can you suffer loss from SIP in equity mutual fund?

For majority of investors, a diversified equity portfolio, bought over time, will prove far less risky than dollar-based securities – Warren Buffett Many equity investors worry about the volatility of equity market. The desire to time the market arises from investor’s desire to avoid loss. But what exactly is loss? Is it decline in the value … Can you suffer loss from SIP in equity mutual fund? Read More »

27 February 2017

How much you need for retirement?

Failing to plan is planning to fail. While our best laid plans may go awry given the glorious uncertainties of life, there is still no excuse to plan. Sometimes, it is difficult to visualize, especially when we are young, what will happen to us when we are old and when we are unable to work. The … How much you need for retirement? Read More »

27 February 2017

Take the plunge, don’t wait for the elusive market correction!

“Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections themselves.” A few weeks ago, at the peak of demonitization gloom, I asked a friend if he was investing in equities. He told me that he would invest only when NIFTY is at … Take the plunge, don’t wait for the elusive market correction! Read More »

27 February 2017

Five tell-tale signs of a ponzi scheme

We all have heard about Saradha groups scandal in which common people were duped of their savings. Instead of getting the lofty and unrealistic returns that they were promised, they soon realized that they have been cheated. This is really very unfortunate. Below, I am going to tell about some characteristics of a ponzi schemes that … Five tell-tale signs of a ponzi scheme Read More »

27 February 2017

Key to wealth creation- Starting early and staying invested

A journey of thousand miles begins with a single step – LAO-TZU Similarly, a journey to achieve financial freedom, journey to accumulate the corpus for your kids education/marriage or your retirement starts with regular and disciplined investing. Most investors are worried more about which stocks or sectors will deliver higher return. They are also more … Key to wealth creation- Starting early and staying invested Read More »

27 February 2017

Why you need to choose the right investment – A Case Study

Yesterday, one of my friend was talking to me. He has been investing in some mutual funds for last few years. The performance of his systematic investments has been good and he has profited from the recent stock market rally. In that context, he mentioned that he will have some surplus around September as one of … Why you need to choose the right investment – A Case Study Read More »