Mutual Funds

56 articles in this category

11 January 2026

Indian Equity Indices in 2026: Big is better

A Review of Index Returns and Valuations with Implications for Investors in 2026 “In the short run, the market is a voting machine, but in the long run, it is a weighing machine.” – Benjamin Graham Here are some reflections on the performance and current valuation of major market indices in 2025 and what it … Indian Equity Indices in 2026: Big is better Read More »

“Many shall be restored that now are fallen and many shall fall that now are in honor” – Horace We have observed many times that stock and sector performance tends to revert to the average over time—a phenomenon known as mean-reversion. This means that if a sector or stock has performed very well, its returns … Evaluating Sector Valuations and Performance: Opportunities and Risks Read More »

5 February 2025

Pros and Cons of Investing in Thematic Mutual Funds

Sure! Here’s a small excerpt for your article: Investing in thematic mutual funds offers both exciting opportunities and significant risks. These funds allow investors to gain concentrated exposure to high-growth themes driven by prevailing economic, technological, or social trends. For instance, the transition from fossil fuels to green energy has garnered significant attention, and thematic funds focusing on this trend offer investors the chance to invest in companies poised to benefit from the shift towards renewable energy sources. However, it’s essential to be aware of the risks, such as the potential to bet on the wrong theme and the need for greater knowledge and monitoring. By conducting thorough research and making informed decisions, investors can potentially reap the rewards of investing in areas that are shaping the future of our world123. I hope this helps! If you need any more assistance, feel free to ask. 😊

2 February 2025

Which sectors are cheap and which are expensive?

Looking at the valuation of various sectors in India using trailing PE ratio, PB ratio and dividend yield The valuation of the Indian market is a hot topic. Our previous article showed that larger caps offer better value than small and mid-caps, while momentum styles are pricier. In this article, we examine sector-specific valuations, noting … Which sectors are cheap and which are expensive? Read More »

1 February 2025

Valuation of Indian market – expensive or not so much?

“The concept of mean reversion is the most powerful tool in the investor’s toolkit.” – Jeremy Grantham NIFTY 50, Midcap, and Small Cap Indices: Analysing Overvaluation Risks and Market Trends The recent performance of the Indian stock market has been marked by challenges. Many analysts attribute this weakness to high valuations amidst clear indications of … Valuation of Indian market – expensive or not so much? Read More »

21 October 2023

NIFTY IT – Is there light at the end of tunnel?

Disclaimer: The below content is just for information and should not be construed as an offer to buy or sell or recommendation. Contact your financial advisor for guidance on any investment related query. This article is just thinking out loud and to document my thoughts at certain points of time about a topic of my … NIFTY IT – Is there light at the end of tunnel? Read More »

14 October 2023

What does NIFTY’s current valuation mean for returns?

Price is what you pay, value is what you get – Warren Buffett Disclaimer: The below content is just for information and should not be construed as an offer to buy or sell or recommendation. Contact your financial advisor for guidance on any investment related query. This article is just thinking out loud and to … What does NIFTY’s current valuation mean for returns? Read More »

8 October 2023

Small and Midcap Funds – What lies ahead?

Small and mid-cap stocks have performed exceedingly well. We analyse valuation and performance and what it means going forward?

5 June 2022

Time to look at banking sector funds?

“Many shall be restored that now are fallen and many shall fall that now are in honour” – Horace Before going any further, I want to clarify that the article is just me jotting down few of my thoughts and analysis. It is neither recommendation or advise. I use this website to document my thoughts … Time to look at banking sector funds? Read More »

Recently we wrote that it could potentially be a good time to buy by purely looking at the recent performance. This was based on the principal of mean-reversion. Periods with low trailing return are followed with period of high return and vice-versa. Here we delve into the valuations of NIFTY. While valuation alone can’t predict … Improved valuation may be harbinger of a better future Read More »

29 May 2022

A good time to invest more

The best time to invest in equity is when the market has fallen and there is pessimism all around. Current environment presents a good opportunity to deploy more capital into equities.

4 October 2020

Time to give time to equity mutual funds

Many of life’s failures are people who did not realize how close they were to success when they gave up. –Thomas Edison Key takeaways: We are potentially moving into a period of time when investment returns may be lower than the historical average. However, the gap between the return from equity mutual funds and risk-free … Time to give time to equity mutual funds Read More »

5 December 2019

What is the best tax saving option?

“In this world, nothing can be said to be certain except death and taxes” – Benjamin Franklin While taxes are certain, there are legitimate ways to reduce taxes. I firmly believe that as responsible citizen, I must pay a fair share of taxes. However, I also believe that we owe it to our family that … What is the best tax saving option? Read More »

28 November 2019

What to do when banks are cutting FD rates?

“If you never try, you will never know.” – Unknown Key takeaways: With falling fixed deposit interest rate, it is time to look at other options that can deliver better post-tax return. Debt mutual funds can be a good alternative to fixed deposit. It is more tax efficient and offers a lot of flexibility. … What to do when banks are cutting FD rates? Read More »

7 July 2019

Mutual fund investments for your child

“Failing to plan is planning to fail.” – Benjamin Franklin Summary: Rising cost of education means we must plan to meet the expenses for our child’s education. The first step is to fix the financial goal. We must ascertain how much money we will need and when will we need it. We can then calculate … Mutual fund investments for your child Read More »

27 September 2018

What to do to increase your investment return?

“When’s the best time to invest? It’s today, not tomorrow” – Charles Schwab Key takeaways: Focus on asset allocation. Equity should form major part of your financial portfolio. Invest systematically (SIP or STP route) in equity for long-term. Increase equity investments during market panic, don’t sell in panic. Have a long-term orientation. Don’t be disheartened by … What to do to increase your investment return? Read More »

22 August 2018

Tracking lost mutual fund investments

“He may be forgotten, but He certainly is not gone!”– Anonymous Summary: It becomes difficult to track investments made long back, especially if you don’t have details like folio number of the investment. Consolidated account statement provided by NSDL and CDSL (only if you have a demat account) is a way to get your stock and … Tracking lost mutual fund investments Read More »

3 April 2018

Bursting some myths about LTCG tax – Part 1

“There is nothing more deceptive than an obvious fact.” ―Arthur Conan Doyle In the latest budget, Finance Minister Arun Jaitley, reintroduced Long-term capital gain tax for equity investments starting 1st April 2018. After the imposition of LTCG tax, there was lot of confusion and discussion. I tried to introduce the concept of LTCG tax on equities … Bursting some myths about LTCG tax – Part 1 Read More »

31 March 2018

All you wanted to know about LTCG taxes on equities!

“In this world, nothing can be said to be certain, except death and taxes.” – Benjamin Franklin In the latest budget, Finance Minister Arun Jaitley, reintroduced Long-term capital gain tax for equity investments starting 1st April 2018. For some time now, It was widely rumoured that such a tax will come into effect. So, when … All you wanted to know about LTCG taxes on equities! Read More »

25 January 2018

NIFTY @ 11000 – Focus on asset allocation

Those who do not learn history are doomed to repeat it – George Santayana Key takaways: Continue SIPs/STPs as timing the market is quite difficult. If you have high equity allocation (80% plus), equity allocation should be reduced by booking some long-term capital gains from equity mutual fund. If the market were to correct, this can … NIFTY @ 11000 – Focus on asset allocation Read More »

7 January 2018

Good time to invest in debt mutual funds

In recent weeks, we have seen yields of government bonds rising. At the same time, government has reduced interest rates on many fixed instruments like NSC, PPF etc. This gives an opportunity to look into the fascinating world of debt mutual funds that can better post-tax return (Fixed deposit or debt mutual fund- What’s better?). … Good time to invest in debt mutual funds Read More »

4 December 2017

Buy or rent a flat- What makes financial sense?

Buying a home is often an emotional decision. Who can argue with a desire to have a roof over your head without having to think about paying the rent every month? However, paying EMI is equally big headache. Especially in current environment where job security is a thing of past. If one is a buying … Buy or rent a flat- What makes financial sense? Read More »

28 November 2017

How much to invest to create 1 crore corpus?

“Spend less than you make; always be saving something. Put it into a tax-deferred account. Over time, it will begin to amount to something. This is such a no-brainer.” — Charlie Munger Having 1 crore rupee (10 million for those outside India) is a nice sum of money. It embeds a sense of security in our … How much to invest to create 1 crore corpus? Read More »

25 November 2017

How to pick the right debt mutual fund scheme?

Most of the time when we talk about mutual funds, it is mostly about equity mutual funds. We often forget about debt mutual funds, that are another interesting segment of the mutual funds. We like debt mutual funds as they can deliver better post-tax return. While debt mutual funds can offer better post-tax return, one … How to pick the right debt mutual fund scheme? Read More »

4 November 2017

Balanced fund or equity fund – Case study

The devil is in the detail. Recently, we wrote about how balanced funds are a good option for steady returns. Indeed, balanced fund with in-built asset allocation tend to navigate the volatile market well. But the proof of pudding is in eating. Hence, we try to look at risk and return characteristics of decent balanced … Balanced fund or equity fund – Case study Read More »

2 November 2017

How to do KYC for mutual fund investments?

The journey of a thousand miles begins with one step- Lao Tzu Many people are interested in investing in mutual funds but are not sure how to go about it? The first step in mutual fund investing is to fulfil “know your customer” or KYC requirement. This requirement has been put to ensure that the … How to do KYC for mutual fund investments? Read More »

21 October 2017

Balance fund – solid option for steady returns

“Rule No.1: Never lose money. Rule No.2: Never forget rule No.1.” – Warren Buffett In investing it is important not to lose money. We can avoid losing money in market by completely remaining out of the market. But if that were the intention, you wouldn’t have been reading it. You have to be “in it” to “win … Balance fund – solid option for steady returns Read More »

16 October 2017

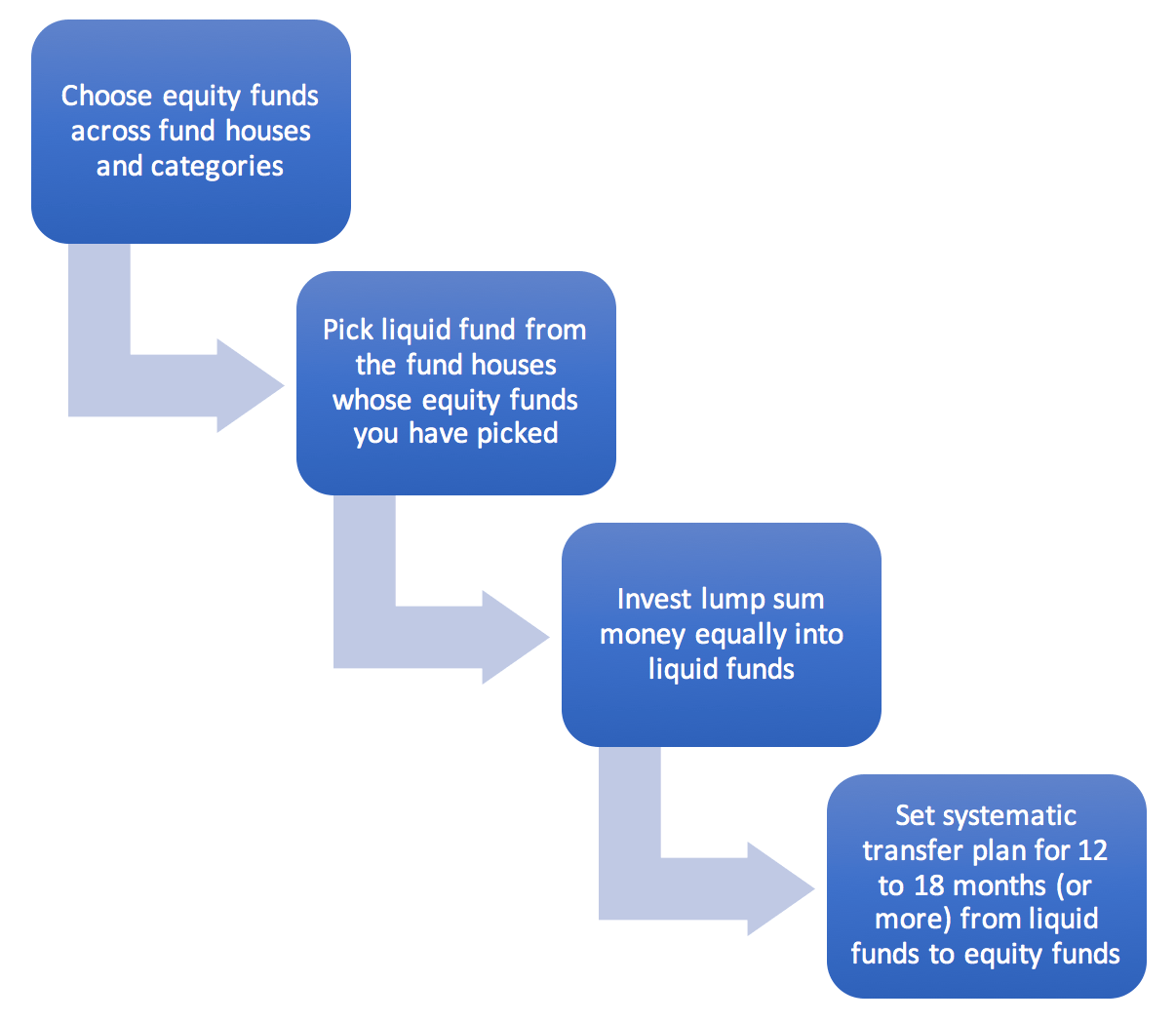

How to invest lump sum amount into equity mutual funds?

Many times people ask me that their LIC policy matured and they have some money to invest. Salaried people get annual bonus which could be a large amount (if you are lucky:)). They ask what’s the best way to invest lump sum amount. Below, I am going to explain how this should be done to … How to invest lump sum amount into equity mutual funds? Read More »

7 October 2017

How expensive is the Indian equity market?

“Only liars manage always to be out of the market during bad times and in during good times.” -Burton Malkiel This simply means that timing the market is almost impossible to do on consistent basis. So, here we are not talking about timing the market but on asset allocation. Any one who was panicking last … How expensive is the Indian equity market? Read More »

4 October 2017

Mutual fund investment strategy for kid’s education

A goal without a plan is just a wish – Antoine de Saint – Exupery This is the third and final part of our series on how to fund kid’s education. In our first article, we got an idea about the cost of higher education at different type of institute in India and abroad (Plan … Mutual fund investment strategy for kid’s education Read More »

29 September 2017

Do’s and don’ts of mutual fund investing

Mutual funds are great way to create wealth. However, there is a big difference in what return mutual funds generate and what return investors get. This is an attempt to bridge the gap between mutual fund returns and your return by avoiding some common mistakes. Some mistakes commonly made are: Trying to time the market … Do’s and don’ts of mutual fund investing Read More »

24 September 2017

How NRIs can invest in Indian mutual funds?

In our earlier video (Why NRIs should invest in India) , we discussed why India remains a compelling investment destination for non-resident Indians. Based on our earlier video, we receive how NRIs can invest in India. We believe the best way to invest in India is through mutual funds. Refer to the NRI section of … How NRIs can invest in Indian mutual funds? Read More »

24 September 2017

Planning for kid’s education- go mutual fund way!

The roots of education are bitter but the fruit is sweet – Aristotle The biggest satisfaction for parents is to see their kid’s well educated and well settled. That’s mission accomplished and a big relief for parents in their retirement years. Many times I meet parents of successful people and I feel a sense of … Planning for kid’s education- go mutual fund way! Read More »

21 September 2017

Plan for kid’s education- How much will it cost?

An investment in knowledge pays the best interest – Benjamin Franklin I studied in a government school where semi-annual fee was 57 rupees. Later on, I qualified to study at one of the IITs, considered the best engineering college in India. During those days (around 20 years ago) the total fee for the 4 year … Plan for kid’s education- How much will it cost? Read More »

14 September 2017

Equity-arbitrage fund – A tax-efficient option

A few weeks ago, we wrote about how debt oriented mutual funds are more tax-efficient than bank fixed deposits. The other day a friend told that fixed deposit rates are falling every day. Indeed, with bank fixed-deposit rate hovering around 6.5%, post-tax return of fixed deposit or interest on saving account balances is quite low, … Equity-arbitrage fund – A tax-efficient option Read More »

3 September 2017

Four key elements of effective investing

Most of the time people looking to invest get bogged down with what return should be expected. Instead of looking at the big picture, we waste time about timing the market (elusive dream of buying at the market bottom and selling at the peak) and high growth. The equation of effective investing is quite simple, … Four key elements of effective investing Read More »

28 August 2017

What return to expect from equities?

Most of the time when people look to invest in equity mutual funds, they ask what return should they expect. Unlike other popular investment options like PPF, fixed deposits etc, where investor has good idea about what return to expect, there is no guarantee for a particular level of return from equities. Lot of people … What return to expect from equities? Read More »

27 August 2017

Prepare for the financial challenges coming your way

Over the last 6 months, a few of my friends were laid off. They are in late 30s and early 40s. They are well educated and have worked at some of the best firms in the world. However, despite their best effort over the last 7-8 months, they have not been able to find suitable … Prepare for the financial challenges coming your way Read More »

19 August 2017

What’s the best tax saving option?

In this world, nothing can be said to be certain, except death and taxes – Benjamin Franklin While Tax is as certain as death, a timely and suitable tax planing could help in saving taxes. Most people remember about tax planning when the payroll department asks for their investment proof. The best time to plan … What’s the best tax saving option? Read More »

Over the last few days, we saw many banks cutting rates on saving account balances. The interest on bank fixed deposits has also fallen. Interest income on bank fixed deposits is clubbed with your taxable income and is taxed at your marginal tax rate. Unlike bank FDs, debt mutual funds offer three key advantages: Easy … Bank cutting rates – Move your cash to debt mutual funds! Read More »

29 July 2017

NIFTY at 10000, so what?

There is a saying in Hindi: धीरे धीरे रे मना धीरे सब कुछ होय | माली सींचै सौ घड़ा ऋतू आये फल होय || This means that everything happens gradually and not before its time. A gardener waters the plants daily but the plants bear fruits only in the right season. In the last few … NIFTY at 10000, so what? Read More »

16 July 2017

How expensive is the Indian equity market?

In last few months, we have seen continues flow of domestic money into equity markets. The monthly systematic investment flow into mutual funds has now grown to almost 4500 crore (MFs get record monthly SIP inflows). This has made Indian stock market far more resilient and less vulnerable to foreign institutional flows. However, increasingly there … How expensive is the Indian equity market? Read More »

The hardest thing to understand in the world is income tax- Albert Einstein Recently, I met an old friend. He is very sceptical about mutual funds and considers them risky. When I talked about debt oriented mutual funds who don’t have the same risk profile as equity funds, he was not convinced. While he agreed … Fixed deposit Vs. debt mutual fund – What to pick? Read More »

25 April 2017

Steps for first time investors

Here is what first time investors need to do “The journey of a thousand miles begins with one step” – Lao Tzu I still remember my 20s, first job, reasonably good money, carefree attitude and having a lot of fun. It seemed as if all the years of hard work, burning midnight oil to study, … Steps for first time investors Read More »

“Where there is an open mind, there will always be a frontier” – Dorothea Brande Most people approach mutual fund investments with some preconceived opinions. They have formed these opinions over a period of time. As a result, many times these preconceived notions prevent them from exploring the versatile world of mutual funds. In this … Dispelling some common misconceptions about mutual funds Read More »

15 April 2017

Systematic investment plans – How to make money?

Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections themselves- Peter Lynch During my initial days of investing, I felt that systematic investment plans are not very smart. However, over the years, I have realized that it is one of the most … Systematic investment plans – How to make money? Read More »

14 April 2017

Using valuation as a guide for asset allocation

I’ve never known anybody who can time the market. I’ve never known anybody who knows anybody who can consistently time the market- Burton Malkiel Aiming to time the market is futile.Purpose of this article is to focus more on asset allocation. We all know that right asset allocation is the main driver of portfolio returns. In … Using valuation as a guide for asset allocation Read More »

27 February 2017

The case for long term debt mutual funds?

The article was first written in May 2015. Since then yield came down crashing and long-term gilt funds delivered great return. The yields have changed since then and there is upside risk and hence, one needs to prefer short term govt bond funds. I am reposting this, just to clarify few conceptual points that many … The case for long term debt mutual funds? Read More »

27 February 2017

Using valuation as a guide for investing

In my personal experience, a simple approach to investing works the best. The simple idea that works is to invest regularly at all times, invest more when valuation is attractive (NIFTY PE less than 18.6) and take some money of the table when valuation is expensive (NIFTY PE >22.1). The below points illustrate this: 1. … Using valuation as a guide for investing Read More »

“The investor’s chief problem—and even his worst enemy—is likely to be himself.” – Benjamin Graham Recently, I have been reading a book on behavioural investing by James Montier. The book gives a lot of insights into the behavioural mistakes that most investors make. It also argues that successful investing a a lot of about following … Cannot control the market, control yourself for investment success Read More »

27 February 2017

Can you suffer loss from SIP in equity mutual fund?

For majority of investors, a diversified equity portfolio, bought over time, will prove far less risky than dollar-based securities – Warren Buffett Many equity investors worry about the volatility of equity market. The desire to time the market arises from investor’s desire to avoid loss. But what exactly is loss? Is it decline in the value … Can you suffer loss from SIP in equity mutual fund? Read More »

27 February 2017

How much you need for retirement?

Failing to plan is planning to fail. While our best laid plans may go awry given the glorious uncertainties of life, there is still no excuse to plan. Sometimes, it is difficult to visualize, especially when we are young, what will happen to us when we are old and when we are unable to work. The … How much you need for retirement? Read More »

27 February 2017

Take the plunge, don’t wait for the elusive market correction!

“Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections themselves.” A few weeks ago, at the peak of demonitization gloom, I asked a friend if he was investing in equities. He told me that he would invest only when NIFTY is at … Take the plunge, don’t wait for the elusive market correction! Read More »

27 February 2017

Five tell-tale signs of a ponzi scheme

We all have heard about Saradha groups scandal in which common people were duped of their savings. Instead of getting the lofty and unrealistic returns that they were promised, they soon realized that they have been cheated. This is really very unfortunate. Below, I am going to tell about some characteristics of a ponzi schemes that … Five tell-tale signs of a ponzi scheme Read More »

27 February 2017

Key to wealth creation- Starting early and staying invested

A journey of thousand miles begins with a single step – LAO-TZU Similarly, a journey to achieve financial freedom, journey to accumulate the corpus for your kids education/marriage or your retirement starts with regular and disciplined investing. Most investors are worried more about which stocks or sectors will deliver higher return. They are also more … Key to wealth creation- Starting early and staying invested Read More »

27 February 2017

Why you need to choose the right investment – A Case Study

Yesterday, one of my friend was talking to me. He has been investing in some mutual funds for last few years. The performance of his systematic investments has been good and he has profited from the recent stock market rally. In that context, he mentioned that he will have some surplus around September as one of … Why you need to choose the right investment – A Case Study Read More »