How to invest lump sum amount into equity mutual funds?

Many times people ask me that their LIC policy matured and they have some money to invest. Salaried people get annual bonus which could be a large amount (if you are lucky:)). They ask what’s the best way to invest lump sum amount. Below, I am going to explain how this should be done to minimize risk.

Don’t invest the lump sum amount in equity fund at one go.

Lump sum investing in equity based mutual fund is fraught with the risk of wrong market timing. If you pick the wrong time, you may soon look at a large loss. Hence, I never recommend lump sum investment in equity (unless NIFTY traling P/E ratio is below 18.5, it can be checked here).

The best way to invest lump sum amount is to invest the lump sum amount in a liquid or ultra short term debt fund and then transfer systematically to an equity fund over the next 12 to 18 months.

For example, you have just received 6 lacs from an LIC policy. You want to invest this amount equally in two mutual funds for 10 years or more. For example, the two mutual funds you want to invest in are HDFC Top 200 Fund and Franklin Templeton Smaller companies fund. You invest 3 lacs each in liquid funds of HDFC Mutual fund and Franklin Templeton mutual fund. While choosing the liquid funds, also check if there is any exit load. Avoid funds who have any exit load.

After investing in the liquid funds, you start systematic transfer into these equity funds. If you want to invest the above amount over 12 months, you can systematically transfer 25000 from both the liquid funds into the respective equity mutual fund (HDFC Top 200 fund and FT Smaller companies fund) every month. Furthermore, it will be better to keep a gap of 15 days between the systematic transaction every month. So, if you transfer the money into HDFC top 200 fund on 5th of every month, plan to transfer the money into FT smaller companies fund on 20th of the month. This will help you in avoiding the risk of wrong market timing.

The other way is to keep the money in bank account and do two SIP (systematic investment plan). This I do not recommend as if you have money in your bank account, there is possibility that you may spend a part of it on items that might not be necessary. The second reason is that liquid funds give annualised return of 7-9% compared to 4% that you normally get in savings bank account. You can also use combination of monthly fixed deposits and SIPs to invest but that may be cumbersome.

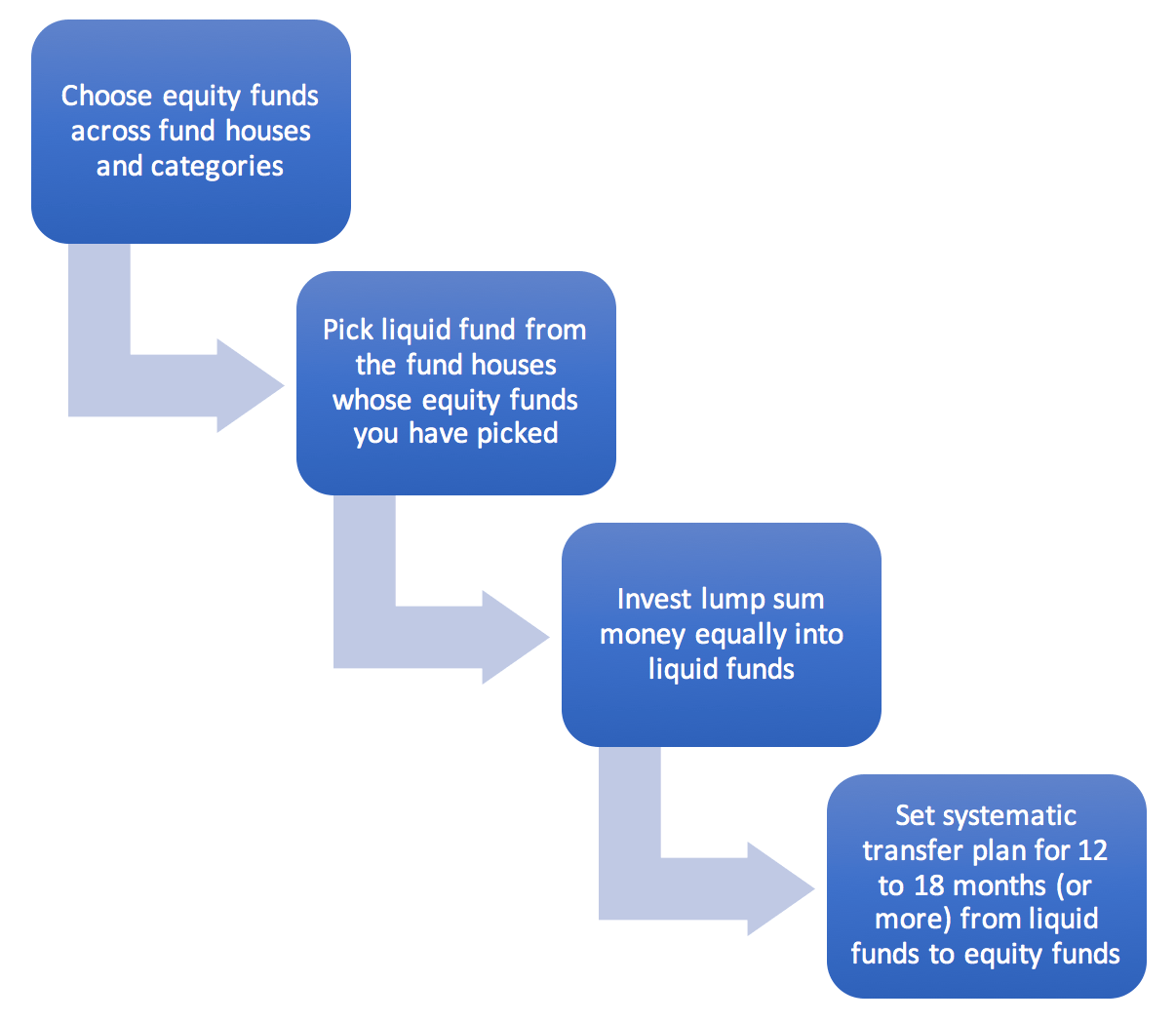

So, finally to summarise, follow the below steps:

- Do not invest lump sum amount in equity mutual funds unless the P/E ratio of NIFTY is less than 18.5. You can check the P/E ratio here.

- Choose 3 or 4 equity mutual fund, depending on the amount you want to invest. Choose mutual fund across fund houses and across category (like one large cap, 1 multi cap and one mid cap)

- Now choose liquid funds available from the mutual fund company whose equity fund you want to invest in. Divide the lump sum money equally and invest in liquid funds. Check for exit loads if any.

- Now systematically transfer (STP) money from liquid funds to equity funds. Its one time activity and every month specified amount will be taken from liquid funds and shifted to equity funds.

- It will be better to keep STP dates separate.

Disclaimer: The above content is just for information and should not be construed as an offer to buy or sell or recommendation. Contact your financial advisor for guidance on any investment related query.

If you liked the above article and would prefer to be notified when we write next, please leave your contact details below: